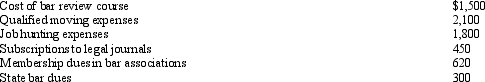

In the current year,Bo accepted employment with a Kansas City law firm after graduating from law school.Her expenses for the year are listed below:

Since Bo worked just part of the year,her salary was only $32,100.In terms of deductions from AGI,how much does Bo have?

Since Bo worked just part of the year,her salary was only $32,100.In terms of deductions from AGI,how much does Bo have?

Definitions:

Financial Condition

An assessment of an entity's ability to meet its financial commitments, based on its assets, liabilities, and equity positions at a given time.

Corporation

A legal entity that is separate and distinct from its owners, which can own assets, incur liabilities, and be sued or sue.

Advantages

Advantages are benefits or favorable factors that contribute to the success and competitiveness of a business or strategy.

Disadvantages

The negative or less favorable aspects of a situation, decision, or item.

Q11: Describe a situation under which a company

Q19: Which,if any,of the following expenses is subject

Q30: Last year,Lucy purchased a $100,000 account receivable

Q42: For the current football season,Rail Corporation pays

Q44: The education tax credits (i.e. ,the American

Q57: Tom owns and operates a lawn maintenance

Q57: If more than 40% of the value

Q62: Kathy is a full-time educator,but she owns

Q65: Services performed by an employee are treated

Q99: For all property placed in service in