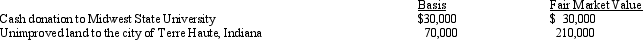

Karen,a calendar year taxpayer,made the following donations to qualified charitable organizations in the current year:  The land had been held as an investment and was acquired 4 years ago.Shortly after receipt,the city of Terre Haute sold the land for $210,000.Karen's AGI is $450,000.The allowable charitable contribution deduction is:

The land had been held as an investment and was acquired 4 years ago.Shortly after receipt,the city of Terre Haute sold the land for $210,000.Karen's AGI is $450,000.The allowable charitable contribution deduction is:

Definitions:

Lower Rates

Typically refers to reduced interest or financing rates, often used to stimulate borrowing or economic activity.

Proprietorships

A business owned and operated by a single individual, where there's no legal distinction between the owner and the business entity.

Corporations

Legal entities formed through a state charter, allowing owners to operate a business while being protected from personal liability beyond their investment.

Amended Returns

The process of revising previously submitted tax returns to correct any errors or include new information.

Q20: For the current year,the base amount for

Q54: Property used for the production of income

Q54: During the year,Walt went from Louisville to

Q61: Al,who is single,has a gain of $20,000

Q66: Amanda uses a delivery van in her

Q68: Brad,who uses the cash method of accounting,lives

Q95: In terms of IRS attitude,what do the

Q116: Bridgett's son,Amos,is $4,500 in arrears on his

Q154: Under § 121 (exclusion of gain on

Q176: Sarah is an executive at Robin Yogurt.Because