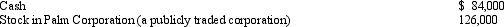

Nick made the following contributions this year to the University of the West:  Nick acquired the stock in Palm Corporation as an investment two years ago at a cost of $56,000.Nick's current AGI is $252,000.What is Nick's current charitable contribution deduction?

Nick acquired the stock in Palm Corporation as an investment two years ago at a cost of $56,000.Nick's current AGI is $252,000.What is Nick's current charitable contribution deduction?

Definitions:

Absolute Refractory Period

A time period immediately following an action potential during which a neuron is incapable of firing a second action potential, no matter the strength of the stimulation.

Sodium Ions

Electrically charged particles of sodium, essential in physiological processes such as nerve impulse transmission and muscle contraction.

Neuron

A particular cell dedicated to transmitting signals in the nervous system; a neuron.

Hippocampus

A component of the brain located within the temporal lobe, crucial for memory formation and spatial navigation.

Q2: Losses on rental property are classified as

Q6: Mel made the following donations to charity

Q34: Roberto,a self-employed patent attorney,flew from his home

Q56: In the current year,Rich has a $40,000

Q62: Seth and Cheryl,husband and wife,own property jointly.The

Q78: The alternate valuation date amount cannot be

Q91: Taxes assessed for local benefits,such as a

Q95: Over the past 25 years,Alfred has purchased

Q111: How are combined business/pleasure trips treated for

Q132: Realized gain or loss is measured by