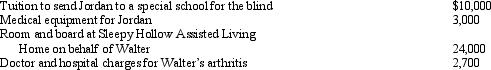

Joe and Nancy are married and file a joint return.They claim Nancy's father (Walter)and Nancy's son (Jordan)as dependents.During the current year,they pay the following expenses:

Walter moved to Sleepy Hollow because he felt living with Joe and Nancy was too noisy.Disregarding percentage limitations,how much qualifies as a medical expense on Joe and Nancy's tax return for:

Walter moved to Sleepy Hollow because he felt living with Joe and Nancy was too noisy.Disregarding percentage limitations,how much qualifies as a medical expense on Joe and Nancy's tax return for:

a.Jordan?

b.Walter?

Definitions:

Political Alliances

Partnerships or associations formed between political entities, such as countries or parties, to advance shared goals or interests.

Formal Authority

indicates the legitimate power granted to an individual or organization by virtue of position or office to make decisions, command resources, or govern.

Force-Coercion Strategy

A change management approach that involves using power to effect change, typically through the application of pressure or the threat of negative consequences.

Formal Authority

Formal authority is the power or right, often vested by an organization, to give orders and make decisions within a designated scope.

Q16: Diane contributed a parcel of land to

Q31: Excess charitable contributions that come under the

Q42: Antiques are not eligible for cost recovery.

Q43: The basis of cost recovery property must

Q61: The low-income housing credit is available to

Q87: Amos sells his principal residence,which has an

Q91: Under the MACRS straight-line election for personality,the

Q94: Kim made a gift to Sam of

Q106: Kevin purchased 5,000 shares of Purple Corporation

Q145: Nancy and Tonya exchanged assets.Nancy gave Tonya