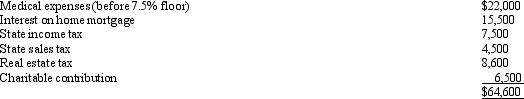

George is single and has AGI of $262,450 in 2010.His potential itemized deductions before any limitations for the year total $64,600 and consist of the following:

After all necessary adjustments are made,what is the amount of itemized deductions George may claim?

After all necessary adjustments are made,what is the amount of itemized deductions George may claim?

Definitions:

Consumer Surplus

The deviation between the cumulative amount consumers are inclined to spend on a good or service and the amount they really spend.

Demand Curve

A graph showing the relationship between the price of a good or service and the quantity of that good or service consumers are willing and able to purchase, typically downward sloping.

Price

The financial sum necessary for acquiring a good or service.

Willingness to Pay

The utmost expenditure an individual is comfortable making on a good or service, demonstrating the value they attribute to it.

Q5: The cost recovery period for new farm

Q6: Taxpayer owns a home in Atlanta.His company

Q11: Rachel acquired a passive activity several years

Q22: John owns and operates a real estate

Q28: Tan Company acquires a new machine (ten-year

Q35: Sarah,John's daughter who would otherwise qualify as

Q69: Statutory employees:<br>A)Report their expenses on Form 2106.<br>B)Include

Q86: In a farming business,MACRS straight-line cost recovery

Q91: An accrual basis taxpayer accepts a note

Q108: On January 15,2010,Vern purchased the rights to