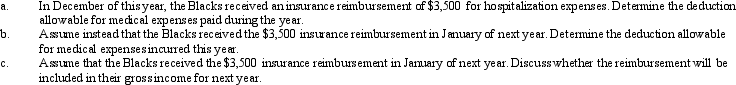

Paul and Patty Black are married and together have current AGI of $140,000.They have two dependents and file a joint return.During the year,they paid $8,000 for medical insurance,$15,000 in doctor bills and hospital expenses,and $1,000 for prescribed medicine and drugs.

Definitions:

Merchandise Inventory

Goods that a retail merchandising business holds for sale to customers.

Periodic Inventory System

An inventory system that records inventory purchase or sales at the end of a period rather than after each transaction.

Cost of Goods Sold

The direct costs attributable to the production of goods sold by a company, including materials and labor costs.

Merchandise Inventory

The goods a company has in stock that are ready to be sold, representing one of the primary sources of revenue for retail and wholesale businesses.

Q1: Discuss the treatment of losses from involuntary

Q2: Molly has generated general business credits over

Q6: Mel made the following donations to charity

Q38: Joseph converts a building (adjusted basis of

Q43: Vanessa's personal residence was condemned,and she received

Q47: Marge purchases the Kentwood Krackers,a AAA level

Q58: Identify how the passive loss rules broadly

Q78: The alternate valuation date amount cannot be

Q78: Jenny spends 32 hours a week,50 weeks

Q102: Intangible drilling costs may be expensed rather