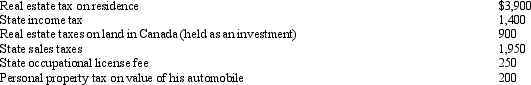

During 2010,Sam,a self-employed individual,paid the following amounts:  What amount can Sam claim as taxes in itemizing deductions from AGI?

What amount can Sam claim as taxes in itemizing deductions from AGI?

Definitions:

Stereotyping

The act of ascribing fixed characteristics to a group of people, disregarding individual diversity.

Self-relevant Information

Information that is directly related to oneself or one's own experiences, often impacting cognitive processes and behaviors.

Possible Selves

The component of the self-concept that includes individuals' ideas about what they might become, what they would like to become, and what they are afraid of becoming.

Feel Bad

A general state of discomfort, sadness, or feeling upset, often in response to a particular situation or set of circumstances.

Q10: Fees for automobile inspections,automobile titles and registration,bridge

Q38: An individual may deduct a loss on

Q39: In the current year,Abby has AGI of

Q52: Sam's office building with an adjusted basis

Q61: A moving expense deduction is not allowed

Q67: Taxpayers must sell or exchange their §

Q68: All listed property is subject to the

Q70: Ralph made the following business gifts during

Q79: On January 15 of the current taxable

Q89: Wendy,who is single,travels frequently on business.Brent,Wendy's 84-year-old