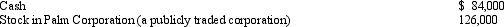

Nick made the following contributions this year to the University of the West:  Nick acquired the stock in Palm Corporation as an investment two years ago at a cost of $56,000.Nick's current AGI is $252,000.What is Nick's current charitable contribution deduction?

Nick acquired the stock in Palm Corporation as an investment two years ago at a cost of $56,000.Nick's current AGI is $252,000.What is Nick's current charitable contribution deduction?

Definitions:

Run-on Sentence

A grammatically faulty sentence in which two or more main clauses are joined without a conjunction.

Comma Splice

A grammatical error where two independent clauses are incorrectly joined by a comma without a coordinating conjunction.

Positive Language

The use of words and phrases that convey optimism and a constructive tone, often to encourage or motivate.

Business Messages

Various forms of communication, such as emails, memos, or letters, used to convey information within a business context.

Q12: Regarding tax favored retirement plans for employees

Q28: Tommy,an automobile mechanic employed by an auto

Q29: A taxpayer who always claims the standard

Q45: Grace's sole source of income is from

Q50: Georgia contributed $2,000 to a qualifying Health

Q52: Sam's office building with an adjusted basis

Q83: The fair market value of property received

Q96: In 2010,Michelle,single,paid $2,500 interest on a qualified

Q138: The total of traditional deductible,traditional nondeductible,and Roth

Q158: A condemned office building owned and used