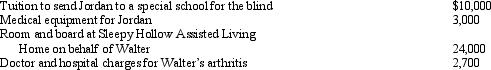

Joe and Nancy are married and file a joint return.They claim Nancy's father (Walter)and Nancy's son (Jordan)as dependents.During the current year,they pay the following expenses:

Walter moved to Sleepy Hollow because he felt living with Joe and Nancy was too noisy.Disregarding percentage limitations,how much qualifies as a medical expense on Joe and Nancy's tax return for:

Walter moved to Sleepy Hollow because he felt living with Joe and Nancy was too noisy.Disregarding percentage limitations,how much qualifies as a medical expense on Joe and Nancy's tax return for:

a.Jordan?

b.Walter?

Definitions:

S&P 500

A stock market index that measures the stock performance of 500 large companies listed on stock exchanges in the United States.

Local Currency Returns

The return on an investment denominated in the currency of the country where the security is issued, ignoring the effects of foreign exchange fluctuations.

Correlation

A statistical measure showing how two securities move in relation to each other.

Composite Risk Rating

An assessment tool that combines multiple risk factors into a single overarching rating to simplify decision-making.

Q7: Under what circumstance is there recognition of

Q17: Which of the following must be capitalized

Q26: The taxpayer owns stock with an adjusted

Q28: A taxpayer who claims the standard deduction

Q30: Carol received nontaxable stock rights on May

Q47: Contributions to a Roth IRA can be

Q90: On June 1,2010,Sam purchased new farm machinery

Q107: Joyce,age 39,and Sam,age 40,who have been married

Q144: After graduating from college with a degree

Q175: If Wal-Mart stock increases in value during