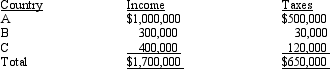

Summer Corporation's business is international in scope and is subject to income taxes in several countries.Summer's earnings and income taxes paid in the relevant foreign countries are:

If Summer Corporation's worldwide income subject to taxation in the United States is $2,400,000 and the U.S.income tax due prior to the foreign tax credit is $816,000,compute the allowable foreign tax credit.If,instead,the total foreign income taxes paid were $550,000,compute the allowable foreign tax credit.

If Summer Corporation's worldwide income subject to taxation in the United States is $2,400,000 and the U.S.income tax due prior to the foreign tax credit is $816,000,compute the allowable foreign tax credit.If,instead,the total foreign income taxes paid were $550,000,compute the allowable foreign tax credit.

Definitions:

Outpatient Facility

A healthcare establishment where patients receive treatment without being admitted to the hospital for an overnight stay.

Operating Room

A specially equipped room in a hospital where surgical procedures are carried out.

Elective Outpatient Surgical Procedure

A planned surgery that does not require an overnight hospital stay, chosen by the patient and not for emergency reasons.

Vacation

A period of time spent away from home or business in travel or recreation.

Q19: Jack owns a 10% interest in a

Q30: In choosing between the actual expense method

Q70: Victor sold his personal residence to Colleen

Q70: Noelle owns an automobile which she uses

Q71: Cora purchased a hotel building on May

Q76: Which of the following is correct?<br>A)Improperly classifying

Q76: Discuss the application of holding period rules

Q86: Tara owns a shoe store and a

Q98: Molanda sells a parcel of land for

Q183: Albert purchased a tract of land for