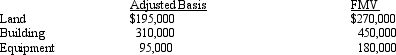

Mona purchased a business from Judah for $1,000,000.Judah's records and an appraiser provided her with the following information regarding the assets purchased:  What is Mona's adjusted basis for the land,building,and equipment?

What is Mona's adjusted basis for the land,building,and equipment?

Definitions:

Legalized Slavery

The condition where slavery is allowed and regulated by law, historically practiced in many parts of the world, including the United States until the 19th century.

Mexican Nationals

Refers to citizens of Mexico, whether living in Mexico or abroad, recognized legally by the Mexican government.

Temporary Worker

An individual employed on a non-permanent basis, often for a specified period or for the duration of a particular project.

Jewish Shopkeepers

Refers to Jewish individuals who own or operate retail businesses, a characterization that touches on both ethnic identity and occupational association.

Q5: Harold is a mechanical engineer and,while unemployed,invents

Q17: Ken has a $40,000 loss from an

Q23: Kelly,who earns a yearly salary of $120,000,sold

Q46: Medical expenses must relate to a particular

Q52: Since most tax preferences are merely timing

Q70: Gold Corporation sold its 40% of the

Q72: In Shelby County,the real property tax year

Q74: What effect does a deductible casualty loss

Q84: If a taxpayer has tentative AMT of

Q106: Factors that can cause the adjusted basis