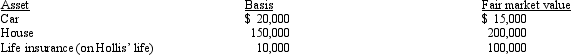

Henrietta and Hollis have been married for 10 years when Hollis dies in a sky-diving accident.Their assets are summarized below.  Henrietta and Hollis reside in Wisconsin,a community property state.All of the assets were acquired with community funds and pass to Henrietta.Her basis for each of the assets becomes:

Henrietta and Hollis reside in Wisconsin,a community property state.All of the assets were acquired with community funds and pass to Henrietta.Her basis for each of the assets becomes:

Car House Cash from life insurance proceeds

Definitions:

Negotiable Instrument

A paper that assures the payout of a certain sum of money, either when requested or at a predetermined time, with the document specifying the person responsible for payment.

Holder In Due Course

A legal term for a person who has obtained a negotiable instrument in a valid manner and has certain protections against defenses and claims that could be asserted against the original party.

Certainty Of Payment

The assurance or guarantee that payment will be made, often a crucial consideration in financial transactions and agreements.

Negotiable Instrument

A written document guaranteeing the payment of a specific amount of money, either on demand or at a set time, with the payer named on the document.

Q37: Kate dies owning a passive activity with

Q41: Noelle received dining room furniture as a

Q46: Lucinda,a calendar year taxpayer,owned a rental property

Q47: Marge purchases the Kentwood Krackers,a AAA level

Q55: Related-party installment sales include all of the

Q56: Compensation that is determined to be unreasonable

Q65: Services performed by an employee are treated

Q68: Brad,who uses the cash method of accounting,lives

Q90: If circulation expenditures are amortized over a

Q135: Robin Corporation has ordinary income from operations