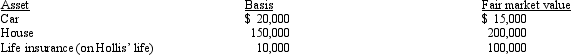

Henrietta and Hollis have been married for 10 years when Hollis dies in a sky-diving accident.Their assets are summarized below.  Henrietta and Hollis reside in Wisconsin,a community property state.All of the assets were acquired with community funds and pass to Henrietta.Her basis for each of the assets becomes:

Henrietta and Hollis reside in Wisconsin,a community property state.All of the assets were acquired with community funds and pass to Henrietta.Her basis for each of the assets becomes:

Car House Cash from life insurance proceeds

Definitions:

Institutionalized

Refers to processes or norms that have been established and accepted within an organization or society as standard or proper.

Corporate Philanthropy

The act of corporations donating some of their profits, or their resources, to charitable causes.

Delay Gratification

The ability to resist the temptation for an immediate reward and wait for a later, often greater, reward.

Maturation

The process of biological growth and development, especially the changes that occur in human life from birth to adulthood.

Q6: Mel made the following donations to charity

Q57: When the IRS requires a taxpayer to

Q66: At the beginning of 2010,the taxpayer voluntarily

Q87: Which of the following correctly reflects current

Q121: Section 1250 depreciation recapture will apply when

Q123: Which,if any,of the following expenses are not

Q128: During 2010,Tracy used her car as follows:

Q160: The holding period of nontaxable stock rights

Q173: Which of the following might motivate a

Q185: An exchange of two items of personal