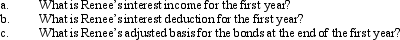

Renee purchases taxable bonds with a face value of $200,000 for $212,000.The annual interest paid on the bonds is $10,000.Assume Renee elects to amortize the bond premium.The total premium amortization for the first year is $1,600.

Definitions:

Competitive Advantage

The attribute that allows an organization to outperform its rivals.

Statistical Quality Control

The application of statistical methods to monitor and control a process to ensure that the quality of products or services meets a specific standard.

Statistical Techniques

Mathematical methods used to collect, analyze, interpret, and present numerical data.

Total Quality Management

A management philosophy that emphasizes a commitment to customer satisfaction by focusing on continuous improvement of business processes.

Q3: Why is there no AMT adjustment for

Q15: Sherri owns an interest in a business

Q27: Which of the following statements concerning the

Q34: Lucy owns and actively participates in the

Q35: Robin Construction Company began a long-term contract

Q44: An expense that is deducted in computing

Q46: Which of the following statements is true

Q53: Bond premium on tax-exempt bonds must be

Q71: Herbert is the sole proprietor of a

Q81: Calico,Inc. ,has AMTI of $235,000.Calculate the amount