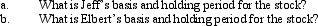

Elbert gives stock worth $28,000 (no gift tax resulted)to his friend,Jeff,on June 8,2010.Elbert purchased the stock on September 1,2003,and his adjusted basis is $22,000.Jeff dies on December 8,2011,and bequeaths the stock to Elbert.At that date,the fair market value of the stock is $31,000.

Definitions:

Insecurely Attached

Insecurely attached refers to a type of attachment style where individuals have difficulty forming secure and trusting relationships, often due to inconsistent caregiving in early life.

Narcissism

A personality trait characterized by an inflated sense of self-importance, a deep need for excessive attention and admiration, and a lack of empathy for others.

Hostility Toward Women

Negative attitudes and feelings of anger, aggression, or resentment towards women, often rooted in sexism or misogyny.

Sexual Orientation

Describes an individual's pattern of emotional, romantic, or sexual attraction to others, based on their gender.

Q28: Copper Corporation owns stock in Bronze Corporation

Q37: Kate dies owning a passive activity with

Q40: Property sold to a related party purchaser

Q58: For a taxpayer who is required to

Q62: Schedule M-1 of Form 1120 is used

Q64: Julia purchased vacant land in 2009 that

Q84: Coyote Corporation has active income of $45,000

Q87: Real property subdivided for resale into lots,even

Q95: Terry pays $8,000 this year to become

Q100: The tax credit for rehabilitation expenditures for