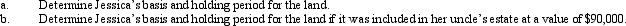

Jessica inherits land from her uncle.His adjusted basis in the land (purchased in November 2004)was $110,000 and it was included in his estate at a value of $225,000.

Definitions:

Net Patient Service Revenue

The total revenue derived from patient services provided by a healthcare institution, net of any allowances for discounts and adjustments.

Third Party Payors

Entities (usually insurance companies or government agencies) that pay for healthcare services on behalf of patients.

Contractual Adjustments

Adjustments made to the gross amount of charges for services provided, primarily in healthcare, based on pre-negotiated agreements with payers or insurers.

Amounts Pledged

The values of assets that have been promised as security for a loan or obligation.

Q6: For purposes of computing the credit for

Q10: Sage,Inc. ,a closely held corporation that is

Q17: Income tax withheld on wages is an

Q27: Which of the following statements concerning the

Q41: Both education tax credits are available for

Q45: Tariq sold certain U.S.Government bonds and State

Q68: In the case of a sale reported

Q74: Tan,Inc. ,has a 2010 $50,000 long-term capital

Q79: A disadvantage to using the accrual method

Q90: If circulation expenditures are amortized over a