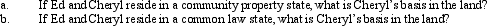

Ed and Cheryl have been married for 27 years.They own land jointly with a basis of $140,000.Ed dies in 2010,when the fair market value of the land is $220,000.Under the joint ownership arrangement,the land passed to Cheryl.

Definitions:

Electroencephalography

A non-invasive method of recording electrical activity of the brain through sensors placed on the scalp, used in diagnosing and treating neurological diseases.

Magnetic Resonance Imaging

A medical imaging technique used to visualize detailed internal structures of the body using magnetic fields and radio waves.

Electroencephalography

A non-invasive procedure that records the electrical activity of the brain using electrodes placed on the scalp, commonly used to diagnose neurological conditions.

Computed Tomography

Computed Tomography, or CT, is a medical imaging technique that uses computer-processed combinations of multiple X-ray measurements taken from different angles to produce cross-sectional images of specific areas of a scanned object.

Q2: Gold Corporation,Silver Corporation,and Platinum Corporation are equal

Q9: Calculate the AMT exemption for 2010 if

Q24: Carolyn mailed a check for $1,000 to

Q31: Excess charitable contributions that come under the

Q32: Which of the following can produce an

Q33: Wolf Corporation has active income of $55,000

Q71: Hilary receives $10,000 for a 13-foot wide

Q74: Glen and Michael are equal partners in

Q104: Omar acquires used 7-year personal property for

Q132: On August 10,2010,Black,Inc.acquired an office building as