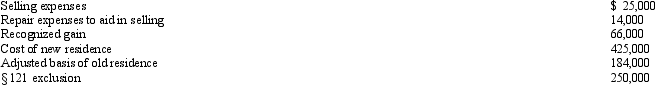

Use the following data to determine the sales price of Tricia's principal residence and the realized gain.She is not married.The sale of the old residence qualifies for the § 121 exclusion.

Definitions:

Dynamic Communication

Communication practices characterized by adaptability, interactivity, and responsiveness to changing contexts or audiences.

Organizational Stake

An interest or share in an undertaking or organization, typically referring to how various stakeholders can affect or be affected by the organization's activities and policies.

Ideological Control

The attempt to influence or control people's beliefs, values, and behaviors through normative ideas and assumptions within an organization or society.

Values and Beliefs

Core principles and assumptions that guide behaviors and interpretations of events by individuals or cultures.

Q24: A taxpayer is considered to be a

Q24: A business taxpayer sold all the depreciable

Q25: During the year,Purple Corporation (a U.S.Corporation)has U.S.-source

Q33: Wolf Corporation has active income of $55,000

Q54: Antonio,who is single and lives alone,is physically

Q76: Which of the following statements is correct?<br>A)A

Q96: On April 8,2010,Oriole Corporation donated a painting

Q102: Original issue discount is amortized over the

Q123: Bakra was the holder of a patent

Q129: Tom has owned 20 shares of Burgundy