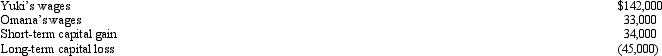

Yuki and Omana,married filing jointly,and both over 65 years of age,have no dependents.Their 2010 income tax facts are:

What is their taxable income for 2010?

What is their taxable income for 2010?

Definitions:

Cultural Values

The collective principles, norms, and ideals that shape a society or organization's behavior and beliefs.

Self-Actualization

Bringing to fruition one's natural talents and possibilities, viewed as an essential impulse or requirement inherent in everyone.

Goal Difficulty

Describes how challenging a set goal is to achieve, which can influence motivation and effort levels.

Learned Needs Model

A theory suggesting that people's needs can be acquired or changed through experiences and interactions with the environment.

Q16: Describe the circumstances in which the maximum

Q18: Akeem,who does not itemize,incurred a net operating

Q34: Several years ago,Sarah purchased a structure for

Q37: An S corporation's tax year,generally,is determined by

Q40: Tan Corporation desires to set up a

Q43: Brown Corporation had consistently reported its income

Q62: If both §§ 357(b)and (c)apply to the

Q101: Maroon Company had $150,000 net profit from

Q113: Al owns stock with an adjusted basis

Q144: The nonrecognition treatment on realized gains of