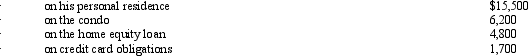

Ted,who is single,owns a personal residence in the city.He also owns a condo near the ocean.He uses the condo as a vacation home.In March 2010,he borrowed $50,000 on a home equity loan and used the proceeds to acquire a luxury automobile.During 2010,he paid the following amounts of interest:  What amount,if any,must Ted recognize as an AMT adjustment in 2010?

What amount,if any,must Ted recognize as an AMT adjustment in 2010?

Definitions:

Auditory Canal

The tube that runs from the outer ear to the middle ear, transmitting sound waves to the eardrum.

Cochlea

A spiral-shaped cavity located within the inner ear, instrumental in converting sound vibrations into nerve impulses for auditory perception.

Middle Ear

The section of the ear located between the eardrum and the inner ear, containing three small bones that transmit sound vibrations.

Sensory Interaction

The process by which different senses, like sight and hearing, influence and interact with each other to form a comprehensive perception.

Q1: Abby sold her unincorporated business which consisted

Q16: In connection with the deduction of organizational

Q35: Lupe and Rodrigo,father and son,each own 50%

Q40: For regular income tax purposes,Yolanda,who is single,is

Q47: A net short-term capital loss first offsets

Q63: What incentives do the tax accounting rules

Q80: Discuss the treatment of realized gains from

Q81: Income that is included in net income

Q82: Azul Corporation,a personal service corporation,had $300,000 of

Q97: Ted is the sole shareholder of a