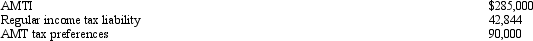

Caroline and Clint are married,have no dependents,and file a joint return in 2010.Use the following selected data to calculate their Federal income tax liability.

Definitions:

Competitive Identity

The unique attributes and qualities that differentiate an organization or brand in the marketplace, influencing public perception and competitive positioning.

Core Benefit Proposition

The fundamental value or advantage that a product or service offers to customers, often serving as the primary reason for a consumer's purchase decision.

Direct Competitors

Businesses or entities that offer the same or very similar goods or services to the same customer or target market.

Catalog Retailer

A business that sells products through catalogs mailed to customers, who can place orders by mail, telephone, or online.

Q1: Discuss the treatment of losses from involuntary

Q2: Zircon Corporation donated scientific property worth $300,000

Q15: Andrew owns 100% of the stock of

Q36: Which of the following statements is correct

Q37: The maximum amount of the unrecaptured §

Q42: In 2010,Father sold land to Son for

Q56: Corporate distributions are presumed to be paid

Q66: The basis of property acquired in a

Q67: During 2010,Ted and Judy,a married couple,decided to

Q90: C corporations can elect fiscal years that