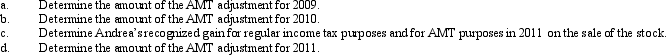

In May 2009,Egret,Inc.issues options to Andrea,a corporate officer,to purchase 200 shares of Egret stock under an ISO plan.At the date the stock options are issued,the fair market value of the stock is $900 per share and the option price is $1,200 per share.The stock becomes freely transferable in 2010.Andrea exercises the options in November 2009 when the stock is selling for $1,600 per share.She sells the stock in December 2011 for $1,800 per share.

Definitions:

Diagnosis

The identification of the nature and cause of a certain phenomenon, typically regarding diseases or medical conditions based on their symptoms and test results.

Uterine Prolapse

A condition where the uterus descends from its normal position into or through the vaginal canal, often due to weakened pelvic floor muscles.

Hysterectomy

A surgical procedure to remove a woman's uterus.

Pelvic Heaviness

A sensation often described as feeling pressure in the pelvic area, commonly associated with conditions affecting the pelvic organs.

Q22: A calendar year,cash basis corporation began business

Q43: Ira,a calendar year taxpayer,purchases as an investment

Q44: An expense that is deducted in computing

Q52: Since most tax preferences are merely timing

Q58: A business taxpayer sells inventory for $40,000.The

Q81: George transfers cash of $150,000 to Grouse

Q81: Ron sold land (a capital asset)to an

Q103: When a patent is transferred,the most common

Q128: If there is a realized gain on

Q193: On July 7,2010,Brad received nontaxable stock rights