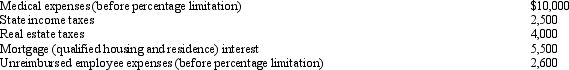

Cindy,who is single and has no dependents,has adjusted gross income of $50,000 in 2010.Her potential itemized deductions are as follows:

What is the amount of Cindy's AMT adjustment for itemized deductions for 2010?

What is the amount of Cindy's AMT adjustment for itemized deductions for 2010?

Definitions:

Mates

Companions or friends often used to describe close relationships among people.

Parental Imperative

Suggests that becoming a parent induces changes in behavior and thinking to meet the demands of parenting, often emphasizing more traditional gender roles.

Traditional Gender Roles

Societal norms dictating the behaviors, actions, and roles deemed appropriate for men and women based on their gender.

Same-Sex Partnerships

Romantic or sexual relationships between individuals of the same sex, recognized legally or socially in many societies.

Q10: Rosie,the sole shareholder of Eagle Corporation,has a

Q13: Tara incorporates her sole proprietorship,transferring it to

Q17: In applying the stock attribution rules to

Q41: Hazel,Emily,and Frank,unrelated individuals,own all of the stock

Q58: For a taxpayer who is required to

Q69: A C corporation must use a calendar

Q74: What effect does a deductible casualty loss

Q82: The exercise of an incentive stock option

Q82: Betty's adjusted gross estate is $7 million.The

Q166: A factory building owned by Amber,Inc.is destroyed