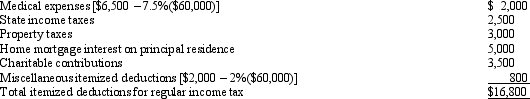

In calculating her taxable income,Rhonda deducts the following itemized deductions.

Calculate Rhonda's AMT adjustment for itemized deductions.

Calculate Rhonda's AMT adjustment for itemized deductions.

Definitions:

Carboxylic Acids

Organic compounds characterized by the presence of at least one carboxyl group, which consists of a carbon atom double-bonded to an oxygen atom and single-bonded to a hydroxyl group.

Nitroglycerin

A highly explosive liquid used medically as a vasodilator to treat heart conditions and industrially in the manufacture of explosives.

Commercial Explosive

Materials or chemicals used in the construction and mining industries, among others, to demolish or move materials through controlled explosions.

Dynamite

An explosive made of nitroglycerin, sorbents (like silica), and stabilizers, invented by Alfred Nobel and used in mining and construction.

Q14: At the beginning of the current year,Dan

Q29: Under the "check-the-box" Regulations,a single-member LLC that

Q46: There is no Federal income tax assessed

Q48: Peter incurred circulation expenditures of $210,000 in

Q52: White Company acquires a new machine for

Q62: Which of the following statements is correct?<br>A)Realized

Q73: Charlotte sold her unincorporated business for $360,000

Q92: Carol,Bonnie,and Ann,sisters,own 300 shares,300 shares,and 400 shares,respectively,in

Q108: Vireo Corporation,a calendar year C corporation,has taxable

Q149: A realized gain on an indirect (conversion