Multiple Choice

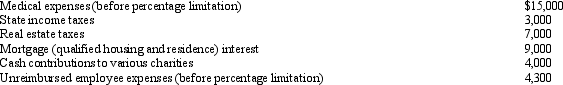

Mitch,who is single and has no dependents,had AGI of $100,000 in 2010.His potential itemized deductions were as follows:  What is the amount of Mitch's AMT adjustment for itemized deductions for 2010?

What is the amount of Mitch's AMT adjustment for itemized deductions for 2010?

Definitions:

Related Questions

Q14: Describe the Federal tax treatment of entities

Q21: All collectibles gain is subject to a

Q23: The Seagull Partnership has three equal partners.Partner

Q51: Gold Corporation,Silver Corporation,and Copper Corporation are equal

Q72: Computer Consultants Inc. ,began business as an

Q88: The required adjustment for AMT purposes for

Q95: Over the past 25 years,Alfred has purchased

Q129: Tom has owned 20 shares of Burgundy

Q181: Ross lives in a house he received

Q190: Property that has been converted from personal