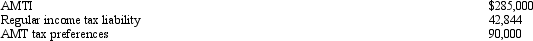

Caroline and Clint are married,have no dependents,and file a joint return in 2010.Use the following selected data to calculate their Federal income tax liability.

Definitions:

Printing Technologies

Various methods and devices used for reproducing text and images onto paper, fabric, or other mediums, including inkjet, laser, and 3D printing.

Inkjet

A type of printer that propels tiny droplets of liquid ink onto paper to create an image or text.

Intel Processors

Microprocessors developed and produced by Intel Corporation, known for their performance and used in a wide range of computing devices.

Socket Types

Different mechanical and electrical interfaces used for connecting a CPU to a motherboard, varying based on the physical layout, pin count, and other specifications.

Q10: Alice,Inc. ,is an S corporation that has

Q28: What is the easiest way for a

Q38: Joseph converts a building (adjusted basis of

Q49: Eagle Corporation owns stock in Hawk Corporation

Q51: Kim owns 100% of the stock of

Q75: John sold an apartment building for $600,000.His

Q76: Discuss the application of holding period rules

Q90: A distribution in excess of E &

Q144: The nonrecognition treatment on realized gains of

Q167: Milt's building which houses his retail sporting