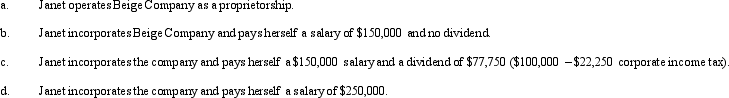

Beige Company has approximately $250,000 in net income in 2010 before deducting any compensation or other payment to its sole owner,Janet (who is single).Assume that Janet is in the 35% marginal tax bracket.Discuss the tax aspects of each of the following arrangements.(Ignore any employment tax considerations. )

Definitions:

Report Card

A document summarizing a student's performance academically over a specific period, usually including grades or marks.

Negative Reinforcement

A behavioral concept where the removal of an adverse stimulus strengthens a desired behavior or response.

Pleasant Stimulus

Any event, object, or situation that causes a positive emotional response.

Unpleasant Stimulus

refers to any object, event, or situation that is undesirable or causes discomfort, leading to avoidance behavior in individuals.

Q2: Tim and Janet are equal partners in

Q22: Brown Corporation purchased 85% of the stock

Q27: Section 1237 allows certain professional real estate

Q48: Silver Corporation redeems all of Alluvia's 3,000

Q65: Assuming no phaseout,the AMT exemption amount for

Q70: Negative AMT adjustments for the current year

Q75: Tricia's office building,which has an adjusted basis

Q79: On January 15 of the current taxable

Q92: Carol,Bonnie,and Ann,sisters,own 300 shares,300 shares,and 400 shares,respectively,in

Q124: Blue Company sold machinery for $45,000 on