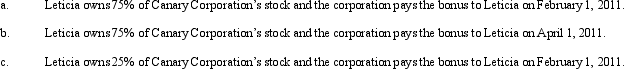

Canary Corporation,an accrual method C corporation,uses the calendar year for tax purposes.Leticia,a cash method taxpayer,is both a shareholder of Canary and the corporation's CFO.On December 31,2010,Canary has accrued a $100,000 bonus to Leticia.Describe the tax consequences of the bonus to Canary and to Leticia under the following independent situations.

Definitions:

Compound

A substance made up of two or more different elements that are chemically bonded together.

Free Radicals

Highly reactive molecules with unpaired electrons, capable of causing cellular damage and contributing to disease processes.

Electrons

Subatomic particles with a negative charge, orbiting the nucleus of an atom and involved in chemical reactions and electricity.

Temperature

An indicator of how hot or cold an object or substance is, compared to a baseline value.

Q1: On January 1,Gull Corporation (a calendar year

Q28: Generally,deductions for additions to reserves for estimated

Q40: Your client has operated a sole proprietorship

Q56: Compensation that is determined to be unreasonable

Q78: Wendy receives a proportionate nonliquidating distribution from

Q83: Ten years ago,Connie purchased 4,000 shares in

Q107: Agnes is able to reduce her regular

Q107: Any loss in current E & P

Q116: Violet Corporation is the sole shareholder of

Q117: In the current year,the CAR Partnership received