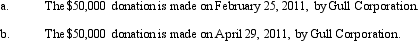

On December 30,2010,the board of directors of Gull Corporation,a calendar year,accrual method C corporation,authorized a contribution of $50,000 to a qualified charitable organization.For purposes of the taxable income limitation applicable to charitable deductions,Gull has taxable income of $420,000 and $370,000 for 2010 and 2011,respectively.Describe the tax consequences to Gull Corporation under the following independent situations.

Definitions:

Populations

Groups of individuals of the same species living and interacting within a specific area.

Nutrient Cycle

The movement and exchange of organic and inorganic matter back into the production of living matter, a key process in ecosystems that recycles nutrients.

Analytical Economist

An economist who utilizes mathematical models and statistical analysis to understand and predict economic behavior and trends.

Ecological Problem

An environmental issue that arises from the interaction of human activities with the natural environment, often leading to negative impacts on ecosystems and biodiversity.

Q11: Dr.Stone incorporated her medical practice and elected

Q35: Robin Construction Company began a long-term contract

Q48: Tax-exempt income at the corporate level does

Q64: Jeremy receives a proportionate nonliquidating distribution from

Q68: Generally,corporations with no taxable income must file

Q73: What kinds of property do not qualify

Q74: Tan,Inc. ,has a 2010 $50,000 long-term capital

Q82: Blue Company signs a 12-year franchise agreement

Q82: Dawn,a sole proprietor,was engaged in a service

Q94: Susan and Sarah form a partnership by