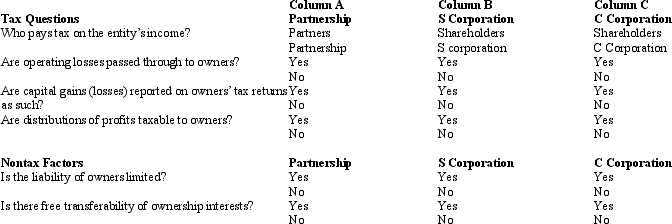

Compare the basic tax and nontax factors of doing business as a partnership,an S corporation,and a C corporation.Circle the correct answers.

Definitions:

Jim Crow

A set of laws and customs in the southern United States enforcing racial segregation and discrimination against African Americans from the late 19th century into the 1960s.

Graduate Schooling

Advanced academic programs beyond an undergraduate degree, leading to a master's or doctoral degree.

Donald Gaines Murray

An African American civil rights activist and attorney, notable for successfully challenging the University of Maryland School of Law's segregation policy in 1935.

Brown Case

Also known as Brown v. Board of Education, a landmark 1954 U.S. Supreme Court decision that declared state laws establishing separate public schools for black and white students to be unconstitutional.

Q16: During the current year,Goldfinch Corporation purchased 100%

Q31: A C corporation is required to annualize

Q51: For purposes of the built-in loss limitation,the

Q60: As a general rule,a liquidating corporation recognizes

Q66: Lark City donates land worth $300,000 and

Q89: Hunter and Warren form Tan Corporation.Hunter transfers

Q105: The "inside basis" is defined as a

Q107: A limited liability company generally provides limited

Q112: Meagan is a 40% general partner in

Q138: In a proportionate liquidating distribution in which