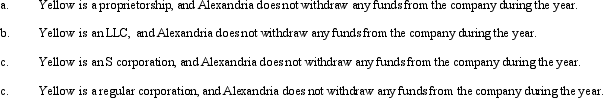

During the current year,Yellow Company had operating income of $380,000 and operating expenses of $300,000.In addition,Yellow had a long-term capital loss of $50,000.Based on this information,how does Alexandria,the sole owner of Yellow Company,report this information on her individual income tax return under following assumptions?

Definitions:

Iron Supplement

A dietary supplement used to increase the amount of iron in the body, often prescribed for anemia.

Constipated

A condition where an individual has difficulty in evacuating bowels, often leading to infrequent and/or painful elimination.

Side Effect

An unwanted or unexpected reaction to a medication or treatment that occurs in addition to the desired therapeutic effect.

Kidney Disease

A condition characterized by the gradual loss of kidney function over time, leading to the buildup of waste products in the blood.

Q12: Wallace owns a construction company that builds

Q26: In 2010,Glenda had a $97,000 loss on

Q54: Regardless of any deficit in accumulated E

Q56: On a partnership's Form 1065,which of the

Q66: Lark City donates land worth $300,000 and

Q68: The dividends received deduction is added back

Q76: Michelle and Jacob formed the MJ Partnership.Michelle

Q79: Holly and Marcus formed a partnership.Holly received

Q96: Karla owned an office building that had

Q104: Paul sells one parcel of land (basis