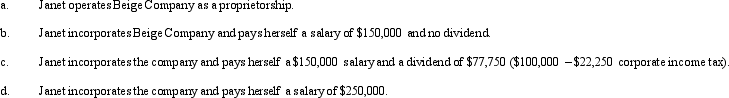

Beige Company has approximately $250,000 in net income in 2010 before deducting any compensation or other payment to its sole owner,Janet (who is single).Assume that Janet is in the 35% marginal tax bracket.Discuss the tax aspects of each of the following arrangements.(Ignore any employment tax considerations. )

Definitions:

Break-even Points

The level of sales at which total revenues equal total costs, resulting in no profit and no loss.

Fixed Expenses

Fixed costs are those that stay the same no matter how much is produced or sold, covering expenses like rental fees, employee salaries, and insurance premiums.

Break-even Sales

The amount of revenue from sales at which a business neither makes a profit nor incurs a loss.

Fixed Expenses

Fixed expenses are costs that do not vary with the level of production or sales, providing stability to a company's budget, such as rent or insurance.

Q3: Discuss the purpose of Schedule M-1.Give two

Q15: Beth's basis in her BBDE LLC interest

Q25: Todd,a CPA,sold land for $200,000 plus a

Q34: A C corporation provides office janitorial services

Q63: Rose's manufacturing plant is destroyed by fire

Q65: The tax basis of the stock and

Q88: The required adjustment for AMT purposes for

Q102: Original issue discount is amortized over the

Q113: Franchising may involve one business obtaining a

Q121: Section 1250 depreciation recapture will apply when