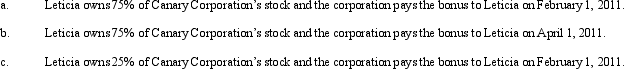

Canary Corporation,an accrual method C corporation,uses the calendar year for tax purposes.Leticia,a cash method taxpayer,is both a shareholder of Canary and the corporation's CFO.On December 31,2010,Canary has accrued a $100,000 bonus to Leticia.Describe the tax consequences of the bonus to Canary and to Leticia under the following independent situations.

Definitions:

Victim

An individual who suffers harm or loss as a result of a crime, accident, or other event or action.

Sexual Contact

Any form of physical interaction between individuals that involves sexual or genital stimulation.

Sexual Behavior

Activities or actions related to the expression of sexuality and sexual feelings towards oneself or others.

Explicit Consent

Clear, unequivocal agreement to participate in an activity or process, often communicated verbally or in writing.

Q11: Corporate taxpayers have a few advantages over

Q36: In determining whether § 357(c)applies,assess whether the

Q47: To close perceived tax loopholes,Congress enacted two

Q59: Franklin Company began business in 2008 and

Q64: For the following exchanges,indicate which qualify as

Q69: A C corporation must use a calendar

Q69: A personal service corporation with taxable income

Q97: The amount of dividend income recognized by

Q107: Agnes is able to reduce her regular

Q144: In 2010 Angela,a single taxpayer with no