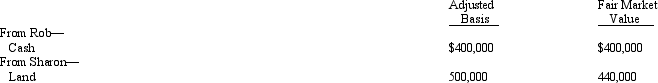

Rob and Sharon form Swallow Corporation with the following consideration:  Each receives 50% of Swallow's stock.In addition,Sharon receives cash of $40,000.One result of these transfers is that Sharon has a:

Each receives 50% of Swallow's stock.In addition,Sharon receives cash of $40,000.One result of these transfers is that Sharon has a:

Definitions:

Opportunity to Learn

The availability or provision of circumstances that allow individuals to acquire new skills or knowledge.

Royalty Fees

The ongoing payments that franchisees pay to franchisors—usually a percentage of gross sales.

Gross Sales

The total revenue generated from goods and services sold by a company before any deductions are made for returns or discounts.

Advertising Fees

Advertising Fees are charges incurred for the promotion of products, services, or a brand through various advertising channels and media, aimed at reaching a wider audience and increasing sales.

Q21: Yard Corporation,a cash basis taxpayer,received $10,000 from

Q44: An expense that is deducted in computing

Q60: Which,if any,of the following items has no

Q61: A corporation may elect to amortize startup

Q65: The dividends received deduction may be subject

Q68: Jon owned a rental building (but not

Q70: Negative AMT adjustments for the current year

Q81: Calico,Inc. ,has AMTI of $235,000.Calculate the amount

Q105: Jay is the sole shareholder of Brown

Q129: An S corporation may not amortize organizational