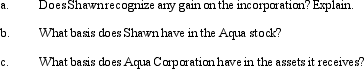

Shawn,a sole proprietor,is engaged in a service business and uses the cash basis of accounting.In the current year,Shawn incorporates his business by forming Aqua Corporation.In exchange for all of its stock,Aqua receives: assets (basis of $380,000 and fair market value of $1.8 million),trade accounts payable of $125,000,and loan due to a bank of $375,000.The proceeds from the bank loan were used by Shawn to provide operating funds for the business.Aqua Corporation assumes all of the liabilities transferred to it.

Definitions:

Monosaccharide

The simplest form of carbohydrates, consisting of a single sugar molecule like glucose or fructose.

Glucose

An essential sugar which is a key source of energy for living entities and a constituent of various carbohydrates.

Disaccharide

A class of sugars composed of two monosaccharide molecules bonded together, such as sucrose or lactose.

Hydrogen Ion

A positively charged atom of hydrogen, symbolized as H+, crucial in acid-base balance and cellular energy processes.

Q9: Similar to the like-kind exchange provision,§ 351

Q48: The gross estate of April,decedent,includes stock in

Q51: Gold Corporation,Silver Corporation,and Copper Corporation are equal

Q62: If both §§ 357(b)and (c)apply to the

Q72: Mauve,Inc. ,has the following for 2009,2010,and 2011

Q77: If the regular income tax deduction for

Q83: The accrual basis taxpayer sold land for

Q93: Unlike individual taxpayers,corporate taxpayers do not receive

Q107: Passive investment income includes gains from the

Q116: An S corporation that has total assets