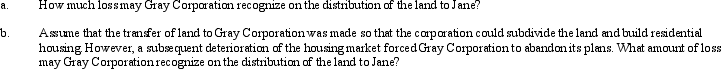

Mary and Jane,unrelated taxpayers,own Gray Corporation's stock equally.One year before the complete liquidation of Gray,Mary transfers land (basis of $300,000,fair market value of $280,000)to Gray Corporation as a contribution to capital.Assume that Mary also contributed other property in the same transaction having a basis of $10,000 and fair market value of $50,000.In liquidation,Gray distributes the land to Jane.At the time of the liquidation,the land is worth $200,000.

Definitions:

Ruling Relations

The power dynamics and authority structures that shape social interactions and decision-making processes.

Psychoanalytic Feminists

A branch of feminism that applies psychoanalytic theories, particularly those of Freud, to explore the roots of gender inequality and psychological oppression.

Subordination

Involves a social or organizational arrangement that places certain groups or individuals in lower or inferior ranks compared to others.

Recognition

The acknowledgment or validation of someone’s status, achievements, rights, or identity by others or by society.

Q13: Lyon has 100,000 shares outstanding that are

Q16: During the current year,Goldfinch Corporation purchased 100%

Q33: Miracle,Inc. ,is a § 501(c)(3)organization involved in

Q38: Donald owns a 40% interest in a

Q40: Nondeductible meal and entertainment expenses must be

Q87: In a proportionate liquidating distribution,UVW Partnership distributes

Q109: A constructive dividend must satisfy the legal

Q128: Dividends taxed at a 15% rate are

Q129: Which of the following qualify as exempt

Q134: A partnership must provide any information to