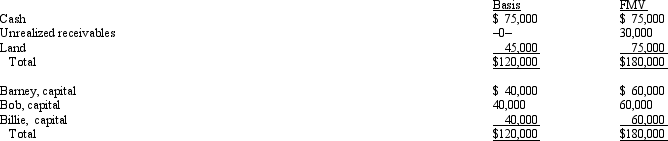

Barney,Bob,and Billie are equal partners in the BBB Partnership.The partnership balance sheet reads as follows on December 31 of the current year:  Partner Billie has an adjusted basis of $40,000 for her partnership interest.If Billie sells her entire partnership interest to new partner Janet for $60,000 cash,how much capital gain and ordinary income must Billie recognize from the sale?

Partner Billie has an adjusted basis of $40,000 for her partnership interest.If Billie sells her entire partnership interest to new partner Janet for $60,000 cash,how much capital gain and ordinary income must Billie recognize from the sale?

Definitions:

Scientific Activity

The process of conducting systematic research to increase knowledge, utilizing empirical evidence and scientific methods.

Public Spaces

Areas that are open and accessible to people, including parks, streets, and public squares, serving as venues for interaction and community life.

Intrinsic Motivation

The desire to behave in a certain way because it is enjoyable or satisfying in and of itself.

External Rewards

Incentives provided by an external source, such as money or praise, that motivate individuals to perform certain tasks.

Q21: An activity is not an unrelated trade

Q41: Hazel,Emily,and Frank,unrelated individuals,own all of the stock

Q44: Perry organized Cardinal Corporation 10 years ago

Q45: In a corporate liquidation governed by §

Q45: MEM Partners was formed during the current

Q63: The excise tax imposed on a private

Q65: The receipt of securities (i.e. ,long-term debt)in

Q70: Help,Inc. ,a tax-exempt organization,incurs lobbying expenses of

Q71: Jose receives a nontaxable distribution of stock

Q101: Maroon Company had $150,000 net profit from