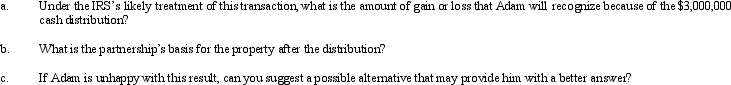

Adam contributes property with a fair market value of $3,000,000 and an adjusted basis of $1,200,000 to AP Partnership.Adam shares in $2,000,000 of partnership debt under the liability sharing rules,giving him an initial adjusted basis for his partnership interest of $3,200,000.One month after the contribution,Adam receives a cash distribution from the partnership of $3,000,000.Adam would not have contributed the property if the partnership had not contractually obligated itself to make the distribution.Assume Adam's share of partnership liabilities will not change as a result of this distribution.

Definitions:

Profit Maximizing

This is the process or strategy businesses employ to achieve the highest possible profit, where marginal revenues equal marginal costs.

Monopolistic Competition

A market structure characterized by many firms selling products that are substitutes but not perfect substitutes, leading to some degree of market power for each firm.

Cournot Duopoly

A market situation where two firms compete with one another by deciding on output quantity with the assumption that the other's decision remains constant.

Rivals

Competitors within the same market that vie for customers and market share by offering similar goods or services.

Q1: Orange,Inc. ,a private foundation,engages in a transaction

Q10: In corporate reorganizations in which the target

Q20: Which exempt organizations are not required to

Q31: Any distribution made by an S corporation

Q48: Typically exempt from the sales/use tax base

Q48: Rodney,the sole shareholder of a calendar year,accrual

Q49: The JIH Partnership distributed the following assets

Q82: By making a water's edge election,the multinational

Q113: Bluebird Corporation's 1,000 shares outstanding are owned

Q128: Amelia,Inc. ,a domestic corporation receives a $100,000