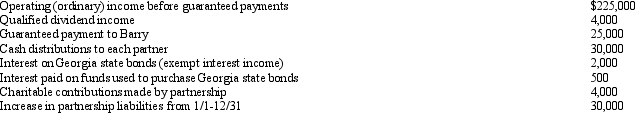

An examination of the RB Partnership's tax books provides the following information for the current year:

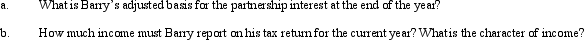

Barry is a 30% partner in partnership capital,profits,and losses.Assume the adjusted basis of his partnership interest is $50,000 at the beginning of the year,and he shares in 30% of the partnership liabilities for basis purposes.

Barry is a 30% partner in partnership capital,profits,and losses.Assume the adjusted basis of his partnership interest is $50,000 at the beginning of the year,and he shares in 30% of the partnership liabilities for basis purposes.

Definitions:

Sales

The process of offering goods or services to obtain money or other forms of payment.

Net Working Capital

The determination of a business's immediate solvency by computing the difference between its current assets and current liabilities.

Total Assets

This financial metric represents the sum of all resources owned by an entity, valued in monetary terms.

Current Liabilities

Obligations that a company needs to pay off within a year, including accounts payable, short-term loans, and accrued expenses.

Q9: For most taxpayers,which of the traditional apportionment

Q19: Although Bowl Corporation's manufacturing facility,distribution center,and retail

Q34: Which statement is incorrect with respect to

Q48: Tax-exempt income at the corporate level does

Q53: The gain postponed by a corporation in

Q55: If a corporation is thinly capitalized,all debt

Q59: Advise your client how income,expenses,gains and losses

Q71: Jim and Marta created the JM Partnership

Q93: Private foundations are permitted to engage in

Q99: Crew Corporation elects S status effective for