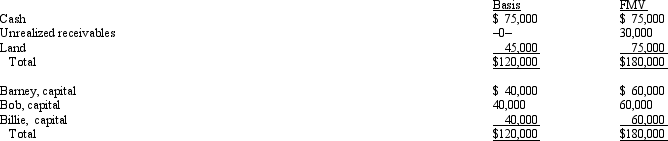

Barney,Bob,and Billie are equal partners in the BBB Partnership.The partnership balance sheet reads as follows on December 31 of the current year:  Partner Billie has an adjusted basis of $40,000 for her partnership interest.If Billie sells her entire partnership interest to new partner Janet for $60,000 cash,how much capital gain and ordinary income must Billie recognize from the sale?

Partner Billie has an adjusted basis of $40,000 for her partnership interest.If Billie sells her entire partnership interest to new partner Janet for $60,000 cash,how much capital gain and ordinary income must Billie recognize from the sale?

Definitions:

Market Research

The process of gathering, analyzing, and interpreting information about a market, including potential customers and competitors.

SWOT Analysis

A strategic planning tool that evaluates Strengths, Weaknesses, Opportunities, and Threats of a business or project.

Competitive Analysis

The systematic evaluation of the strengths and weaknesses of current and potential competitors.

Technological Environment

Refers to the set of technological conditions and developments that affect the operation and performance of businesses.

Q11: When a taxpayer transfers property subject to

Q17: A typical state taxable income addition modification

Q24: In the current year,Dove Corporation (E &

Q32: Summarize the principles of multistate tax planning.

Q34: Generally,gain is recognized on a proportionate current

Q75: In the current year,Amber,Inc. ,a calendar C

Q85: Dividends received from Shamrock,Ltd. ,an Irish corporation

Q88: The property factor includes assets that the

Q89: During the current year,Gander Corporation sold equipment

Q126: Samantha owned 1,000 shares in Evita,Inc. ,an