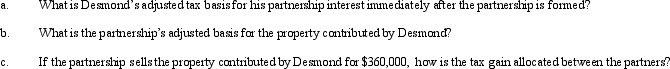

Joel and Desmond are forming the JD Partnership.Joel contributes $300,000 cash and Desmond contributes nondepreciable property with an adjusted basis of $80,000 and a fair market value of $330,000.The property is subject to a $30,000 liability,which is also transferred into the partnership and is shared equally by the partners for basis purposes.Joel and Desmond share in all partnership profits equally except for any precontribution gain,which must be allocated according to the statutory rules for built-in gain allocations.

Definitions:

Power Distance

The extent to which less powerful members of institutions and organizations within a country expect and accept that power is distributed unequally.

Formal Power Relationship

A structured and officially recognized relationship within an organization where one individual has authority over others based on their position or role.

Subordinates

Individuals who report to and are under the supervision of someone with higher authority within an organizational hierarchy.

Formal Hierarchy

An organizational structure where roles and responsibilities are clearly defined, ranked, and allow for direct lines of authority and command.

Q3: In conducting multistate tax planning,the taxpayer should:<br>A)Review

Q4: All of the stock in Robin Corporation

Q34: Penny,Miesha,and Sabrina transfer property to Owl Corporation

Q55: A nonresident alien is defined as someone

Q71: Geneva,a sole proprietor,sold one of her business

Q80: Country,Inc. ,an exempt organization,has included among other

Q90: Jamie owns a 40% interest in the

Q95: A corporation with $10 million or more

Q100: Alicia and Barry form the AB Partnership

Q105: José Corporation realized $600,000 taxable income from