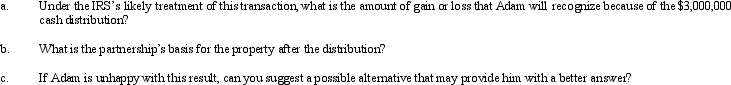

Adam contributes property with a fair market value of $3,000,000 and an adjusted basis of $1,200,000 to AP Partnership.Adam shares in $2,000,000 of partnership debt under the liability sharing rules,giving him an initial adjusted basis for his partnership interest of $3,200,000.One month after the contribution,Adam receives a cash distribution from the partnership of $3,000,000.Adam would not have contributed the property if the partnership had not contractually obligated itself to make the distribution.Assume Adam's share of partnership liabilities will not change as a result of this distribution.

Definitions:

Personal Attention

The care and consideration given to someone's needs or concerns in a detailed and individualized manner.

Time Management Strategies

Time management strategies involve techniques and tools to use one's time more efficiently, prioritizing tasks to achieve goals with less stress.

Learning Style

The preferred way an individual processes information, which can significantly influence their ability to effectively learn new information.

Take Control

The action or process of asserting dominance, authority, or management over a situation, leading to directed and intentioned outcomes.

Q2: The stock in Black Corporation is owned

Q14: A state sales tax is designed to

Q47: Nonbusiness income includes rentals of investment property.

Q65: For Federal income tax purposes,a distribution from

Q74: Only 51% of the shareholders must consent

Q84: Shareholders may deduct losses in excess of

Q90: A distribution in excess of E &

Q93: Non-separately computed loss _ a S shareholder's

Q96: Wonder,Inc. ,a § 501(c)(3)exempt organization,acquired all the

Q156: Francine receives a proportionate liquidating distribution when