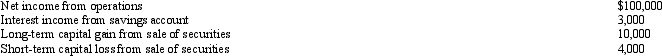

During 2010,Lion Corporation incurs the following transactions.  Lion maintains a valid S election and does not distribute any assets (cash or property) to its sole shareholder,Penny.As a result,Penny must recognize:

Lion maintains a valid S election and does not distribute any assets (cash or property) to its sole shareholder,Penny.As a result,Penny must recognize:

Definitions:

Societies

Groups of individuals living together in organized communities with shared laws, traditions, and values.

Happy And Prosperous

A state of being characterized by contentment, joy, and success in life's endeavors.

Free

Not under the control or in the power of another; able to act or be done as one wishes.

Construct An Argument

The process of logically assembling reasons, evidence, and facts to support a statement, proposition, or conclusion.

Q2: The § 1374 tax is a corporate-level

Q4: One advantage of acquiring a corporation via

Q5: A capital loss allocated to a shareholder

Q5: Circular 230 prohibits a tax preparer from

Q52: Define "trade or business" for purposes of

Q64: Kingbird Corporation (E & P of $800,000)has

Q82: FLCo,a U.S.corporation,has $250,000 interest expense for the

Q102: Excess net passive income of an S

Q104: When loss assets are distributed by an

Q114: Under certain circumstances,an organization that labels itself