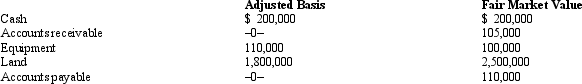

Apple,Inc. ,a cash basis S corporation in Orange,Texas,formerly was a C corporation.Apple has the following assets and liabilities on January 1,2010,the date the S election is made.  During 2010,Apple collects the accounts receivable and pays the accounts payable.The land is sold for $3 million,and taxable income for the year is $590,000.What is Apple's built-in gains tax?

During 2010,Apple collects the accounts receivable and pays the accounts payable.The land is sold for $3 million,and taxable income for the year is $590,000.What is Apple's built-in gains tax?

Definitions:

Private Wrong

A legal injury or violation affecting an individual or a specific entity, as opposed to the public or society at large.

Tort Suit

A legal action enabling a person to seek damages against another for a wrongful act that caused harm or loss.

Criminal Actions

Legal proceedings brought by the state against individuals or entities accused of violating criminal laws.

Public Wrongs

Acts or omissions that violate public laws and are considered offenses against the state or society, typically referred to as crimes.

Q7: Which of the following is not immune

Q21: Once a gain is recognized in a

Q27: Marianne is a 50% partner in the

Q31: George is running for mayor of Culpepper.The

Q38: Constructive dividends have no effect on a

Q58: For Federal income tax purposes,taxation of S

Q64: Jeremy receives a proportionate nonliquidating distribution from

Q86: Under no circumstances can a distribution generate

Q130: An S shareholder's basis does not include

Q142: Barry owns a 25% interest in a