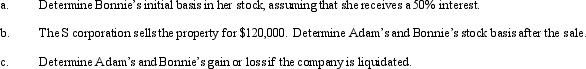

Individuals Adam and Bonnie form an S corporation,with Adam contributing cash of $100,000 for a 50% interest and Bonnie contributing appreciated ordinary income property with an adjusted basis of $20,000 and a fair market value of $100,000.

Definitions:

Ski Resort

A specialized tourist facility that offers skiing and snowboarding activities along with amenities like lodging, food services, and equipment rental.

Golf Resort

A specialized leisure facility often combining a hotel and golf courses along with other amenities such as spa services, restaurants, and event spaces.

Acquisition of Assets

The process through which a company buys assets, which could range from tangible assets like equipment to intangible assets like patents.

Hostile Takeover

An acquisition attempt by a company or individual against the wishes of the company's management and board of directors.

Q11: Which of the following is subject to

Q12: Federal income tax paid in the current

Q25: A corporation borrows money to purchase State

Q28: A church that is exempt under §

Q75: Which of the following statements regarding a

Q101: The LMO Partnership distributed $30,000 cash to

Q104: The _ tax usually is applied at

Q119: A corporation that distributes a property dividend

Q123: Performance,Inc. ,a U.S.corporation,owns 100% of Krumb,Ltd. ,a

Q134: Puce Corporation,an accrual basis taxpayer,has struggled to