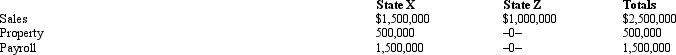

José Corporation realized $600,000 taxable income from the sales of its products in States X and Z.José's activities in both states establish nexus for income tax purposes.José's sales,payroll,and property among the states include the following.  X utilizes an equally weighted three-factor apportionment formula.How much of José's taxable income is apportioned to X?

X utilizes an equally weighted three-factor apportionment formula.How much of José's taxable income is apportioned to X?

Definitions:

Work Force

The total number of individuals employed by a company or available for employment, including both full-time and part-time employees.

Global Network Design Decisions

Strategic decisions involving the configuration and management of a supply chain on a global scale, focusing on locations, transportation modes, and logistics infrastructure.

Available Infrastructure

The existing facilities and systems serving a country, city, or area, including transportation and communication systems, power plants, and schools.

Skill Needs

The specific abilities and expertise required for performing certain tasks or jobs effectively.

Q18: Under most local property tax laws,the value

Q19: In a proportionate nonliquidating distribution of a

Q21: Which of the following statements regarding the

Q28: A church that is exempt under §

Q55: An S corporation can be a shareholder

Q55: Describe the following written determinations that are

Q72: Distribution of appreciated property is taxable to

Q75: How can an exempt organization,otherwise classified as

Q107: The throwback rule requires that:<br>A)Sales of services

Q107: What is the purpose of the unrelated