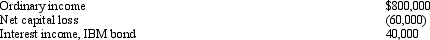

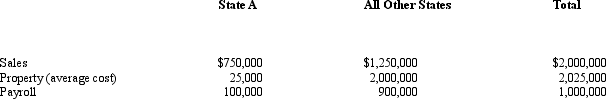

You are completing the State A income tax return for Quaint Company.Quaint is a limited liability company,and it operates in various states,showing the following results.

In A,all interest is treated as business income.A uses a sales-only apportionment factor.Assuming the following data are correct,compute Quaint's A taxable income.

In A,all interest is treated as business income.A uses a sales-only apportionment factor.Assuming the following data are correct,compute Quaint's A taxable income.

Definitions:

Automatic Market Adjustments

The self-regulating behavior of markets where prices and quantities adjust to changes in demand and supply conditions without external intervention.

Purely Competitive Firm

A market structure where firms are price takers and sell homogeneous products with many buyers and sellers, leading to perfect competition.

Economic Profit

The contrast between a company's overall receipts and its full charges, considering both palpable and inferred costs.

Long Run

A time period in economics during which all factors of production and costs are variable, allowing for all adjustments to be made to achieve an equilibrium.

Q30: A distribution can be "proportionate" even if

Q35: Gain or loss on the exchange of

Q42: Which of the following types of §

Q65: The corporate _ tax is avoided in

Q70: Which one of the following statements regarding

Q92: Which of the following would not prevent

Q97: Which of the following statements relating to

Q112: Which of the following statements is false

Q114: Concerning the formula for the Federal estate

Q138: WorldCo,a foreign corporation not engaged in a