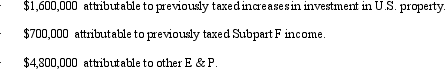

\Benchmark,Inc. ,a U.S.shareholder owns 100% of a CFC from which Benchmark receives a $3 million cash distribution.The CFC's E & P is composed of the following amounts.  Benchmark recognizes a taxable dividend of:

Benchmark recognizes a taxable dividend of:

Definitions:

Funds Flow

The movement of money into and out of an organization, project, or financial product, typically analyzed for assessing financial health.

Excise Tax

A tax on the sale or use of specific products or transactions.

Excise Tax

A tax levied on specific goods or activities, such as alcohol, tobacco, and gasoline, often intended to discourage their use or to raise revenue.

Sales Tax

A tax imposed by governments on the sale of goods and services, adding on to the purchase price paid by consumers.

Q2: The § 1374 tax is a corporate-level

Q12: What taxpayer penalties can arise when a

Q12: The Purple Trust incurred the following items

Q20: Which exempt organizations are not required to

Q60: Which,if any,of the following items has no

Q77: All tax preference items flow through the

Q82: By making a water's edge election,the multinational

Q92: The unrelated business income tax (UBIT)is designed

Q106: At the time of his death on

Q122: Dividends received from a domestic corporation are