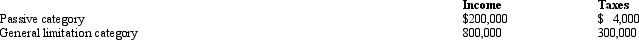

BendCo,Inc. ,a U.S.corporation,has foreign-source income and pays foreign taxes as follows.

BendCo's worldwide taxable income is $1,600,000 and U.S.taxes before FTC are $560,000 (assume 35%).What is BendCo's U.S.tax liability after the FTC?

BendCo's worldwide taxable income is $1,600,000 and U.S.taxes before FTC are $560,000 (assume 35%).What is BendCo's U.S.tax liability after the FTC?

Definitions:

Contractually Agreed Upon Fee

A fee that parties have explicitly decided upon within a contract for services or goods.

Damages

Monetary compensation required to be paid as a remedy for a breach of contract or a tortious act.

Sarbanes-Oxley Act

A U.S. federal law established to protect investors by improving the accuracy and reliability of corporate disclosures.

Regulatory Body

A regulatory body is an organization established by the government to regulate specific industries, sectors, or practices, ensuring compliance with laws and protecting public interest.

Q4: S corporations are treated much like _

Q29: Almost all of the states assess some

Q47: CPA Jennifer has heard about the AICPA's

Q47: Nonbusiness income includes rentals of investment property.

Q47: You are a 60% owner of an

Q56: Yosef Barbutz,an NRA,is employed by Fisher,Inc. ,a

Q58: Which of the following are consequences of

Q61: How could the § 2513 election to

Q81: Circular 230 allows a tax preparer to:<br>A)Take

Q116: At the time of his death,Asa held