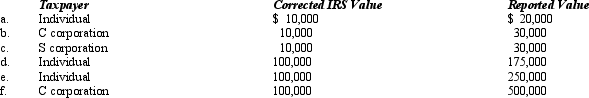

Compute the overvaluation penalty for each of the following independent cases involving the taxpayer's reporting of the fair market value of charitable contribution property.In each case,assume a marginal income tax rate of 35%.

Definitions:

Grammar

A group of established principles that control the formation of words, phrases, and clauses in a particular natural language.

Reduced Risk

Pertains to lowering the likelihood or severity of potential negative outcomes or harms.

Obesity

is a medical condition characterized by excessive body fat accumulation, which can negatively impact health.

Allergies

An immune system response to a foreign substance that's not typically harmful to the body, such as pollen, food, or pet dander.

Q5: Typically exempt from the sales/use tax base

Q33: A letter ruling is issued by the

Q64: The difference between the balance in Accounts

Q66: The accuracy-related penalties of _% or more

Q74: ForCo,a foreign corporation,receives interest income of $50,000

Q84: All losses are apportioned against U.S.-source income.

Q92: Journalize the following transactions using the direct

Q115: Rose,Inc. ,a qualifying § 501(c)(3)organization,incurs lobbying expenditures

Q118: Most states' consumer sales taxes apply directly

Q165: The balance in Allowance for Doubtful Accounts